- #Simple accounting software for self employed plus#

- #Simple accounting software for self employed professional#

- #Simple accounting software for self employed free#

Filter transactions, match receipts with expenses on the go, customize invoices, make payments and view trends and insights about your business. Neat is popular with self-employed entrepreneurs because it’s so easy to use. QuickBooks is a good choice for freelancers and small businesses that need a simple way to track expenses, organize receipts and log mileage. The Advanced plan is $90 per month and includes more than five users, business analytics and insights, management of employee expenses, batch invoices and expenses, customized access by role, exclusive app integrations and automated processes and tasks.

#Simple accounting software for self employed plus#

With its Plus plan, it includes up to five users, and you can track inventory and project profitability for $40 per month. It starts at $7.50 per month and allows for tracking income and expenses, invoicing, accepting payments, maximizing tax deductions, running reports, capturing and organizing receipts, tracking miles, managing cash flow, tracking sales and sales tax, sending estimates and managing 1099 contractors.įor $25 per month, get the Essentials plan and have up to three users, manage and pay bills and track time. With its straightforward accounting software, QuickBooks is an easy favorite amongst freelancers, and not just because many of them bundle it when filing their own taxes with its tax software.

The software is also a good fit for service-based businesses, such as consultants, web designers and photographers.

Its Premium plan is $20 per month for unlimited billable clients and invoices, track bills, bill payments and vendors with Accounts Payable, track project profitability, customize email templates and email signatures and more.įreshBooks is a good choice for small business owners who want easy-to-use accounting software. This comes with unlimited invoices to up to 50 clients, everything in the Lite plan, plus recurring billing and client retainers, business health reports, double-entry accounting reports, invite your accountant and track mileage via your mobile. With up to 50 billable clients, pay $10 per month for its Plus plan. The plan includes unlimited expense tracking, unlimited estimates, accept credit cards and bank transfers, track sales, see reports and send unlimited invoices to up to five clients. If you have less than six clients, you can sign up for FreshBooks’ Lite plan for $6 per month. Besides its primary plans, it also offers a custom plan with custom pricing for businesses with complex needs. You can create and send invoices, track expenses, manage projects and clients and view reports. The software is designed for small business owners who don’t have an accounting background. It’s also a good fit for service-based businesses, such as consultants, landscapers and plumbers.įreshBooks is one of the easiest accounting software to use. Zoho Books is a good choice for small businesses that are already using Zoho products and services because it integrates well with other Zoho apps. The Premium plan is $30 per organization per month (billed annually) and comes with a custom domain, vendor portal, budgeting and validation rules.

#Simple accounting software for self employed professional#

Its Professional plan costs $20 per organization per month (billed annually), and includes bills, vendor credits, purchase approval, stock tracking and price lists. Its Standard plan comes with even more support options, custom fields, reporting tags and bulk updates for $10 per organization per month, billed annually. It comes with one user or accountant, and lets you manage clients and invoices, create recurring invoices, import bank and credit card statements, and track expenses and mileage.

#Simple accounting software for self employed free#

If you have less than $50,000 per year in revenue, you can sign up for the Zoho Books Free plan. The software also offers advanced features such as project accounting and time tracking.

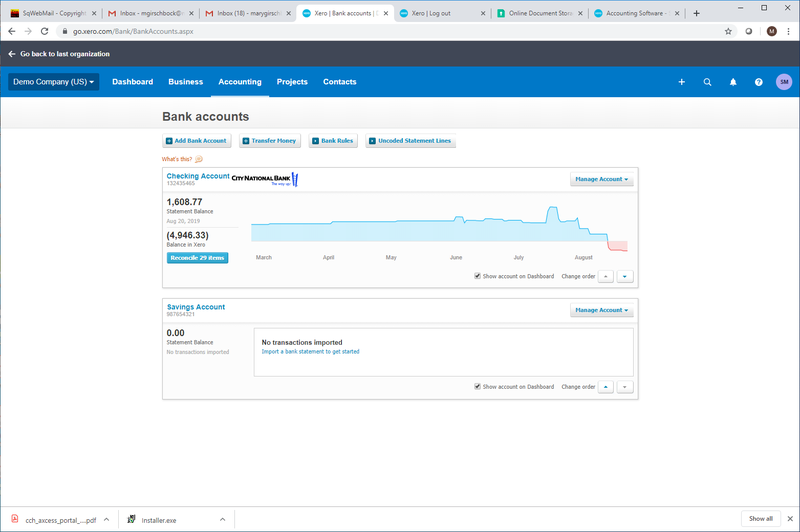

This gives you a real-time view of your finances. You can connect your bank account, payment processor, e-commerce platform and more to Zoho Books. Where Zoho Books shines is its integrations. Zoho Books meets all your basic needs: send invoices, reconcile accounts, track expenses and generate reports. It’s one of the most comprehensive accounting software on the market. If you’re a fan of Zoho apps, then you’ll be a fan of Zoho Books.

0 kommentar(er)

0 kommentar(er)